1,000 Years of Stewardship

- Ryan Young

- YESCO

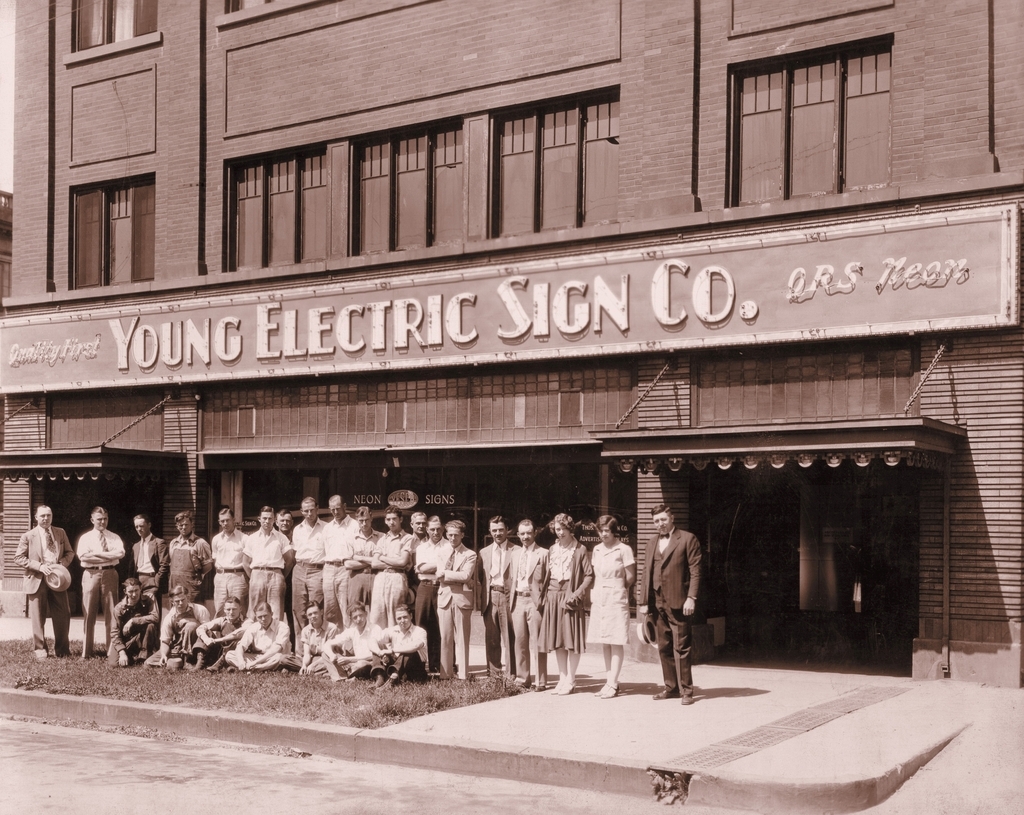

The story of the modern Western United States is a story of pioneers. My great-grandfather, Thomas Young, was one of these pioneers. He was drawn to these wide-open spaces by his faith and a belief that he could build a better life here. Leaving his native England at age 15, Tom and his family crossed an ocean and a continent, arriving in Ogden, Utah in 1910. Early on, he showed a talent for fine art. At age 20, the young entrepreneur founded Thomas Young Sign Company, specializing in hand lettering window signs. Neon was invented in France in 1910, and in 1928, Young purchased the license to manufacture neon signs in the Southwestern U.S.. The company name became Young Electric Sign Company (YESCO). Tom’s travels selling signs in Utah and California often found him passing through a sleepy rest stop in Southern Nevada called Las Vegas. In 1931, gambling was legalized in Nevada and the construction of the Hoover Dam began, with 5,000 workers pouring into the Las Vegas area. The first Las Vegas casinos opened, and by 1934, he had a make-shift office in the Apache Hotel designing neon signs by night and selling his designs by day.

Today, YESCO is a 105-year-old family-owned business with four primary sign manufacturing facilities and 36 sales and service offices in the Western US. We also operate a network of over 127 franchised sign and lighting maintenance offices east of the Rocky Mountains and in Canada. In 2021, I became the fourth CEO of the company, taking the place of my uncle who led the organization for 33 years.

At Tugboat Institute®, we talk about building companies that will last for 100 years or more. Outside of Tugboat, to non-Evergreen® leaders, this can sound ambitious and even unrealistic. So imagine the reaction I get when I tell people that we have just transferred ownership of our fourth-generation family business to a 1000-year trust! Yes, one thousand years. Here is the story.

My great-grandfather built his business for over 50 years, and while Evergreen did not exist at the time, his actions embodied the Evergreen 7Ps® principles. Recognizing the illiquidity of the company as he neared the end of his tenure, my great-grandfather realized he had a challenge to overcome. He had six children and liquidating the business could destroy everything he had built and endanger the jobs of his valued co-workers. So, he made a pivotal decision: he gave virtually all voting stock to one son, my grandfather, while non-voting shares were distributed amongst the other siblings. They each received some economic value from this arrangement, but my grandfather became the primary owner of YESCO. This ‘gift’ came with a very clear directive. My great-grandfather told his son that he had built the business alongside many great people, and that it was critical to him that those individuals be rewarded for their hard work. He told him that in handing him the reins of the business, he was charging him with carrying the torch forward, and to continuing to build something that would benefit all who participated in the effort. While Tom did not use the word stewardship, we have come to know that this is exactly what he was asking of my grandfather.

This arrangement did succeed in balancing control and economic value, though it also created tension and challenges within the family. YESCO did not, and still never has, made distributions to owners. Rather, it reinvests 100% of profits back into the business. This tension culminated in a major dispute that threatened the existence of the company. The dispute was ultimately resolved with a great outcome for the company and a modest share repurchase program. But the relationships between my grandfather and two of his siblings were permanently damaged.

Fast forward to the early 1990s, it came time for my grandfather to think about his own retirement. He was faced with similar estate concerns as his father. With five children, three of whom worked in the business, he sought his own solution that would preserve the company, and above all, the family relationships. His decision was transformative; he decided to make a move that would ultimately transform our family from a family of owners to a family of stewards. Rather than realize an economic windfall from his shares, he chose to gift them to the 100-year YESCO Stewardship Trust and passed leadership to my uncles and father, who would become trustees and stewards of YESCO.

A published article by family business experts Craig Aronoff and John Ward called The Critical Value of Stewardship was foundational for the development of our family’s creed and purpose. Here are a few of the core beliefs that came from this article and this period of transition:

• Stewardship is our duty to enhance the family’s resources for the benefit of employees and the community, as well as future generations of the family.

• Motivation inspired merely by increasing personal power and wealth fails to sustain families through the generations.

• The results of responsible stewardship provide the moral basis of private enterprise and justify the privilege of inheritance of private property.

• Having received the resources to continue creating value, subsequent generations must also accept responsibility and transmit talents and values.

• Personal well-being does not come from having money, but is achieved by building talents and character, experiencing accomplishment, learning from mistakes, and living with integrity.

So, how do you ensure that your children build character and that when they take over the company you built, they share your values and vision for the company and its future? Families have solved this problem in many ways, but my grandfather zeroed in on replacing the ownership mentality with a stewardship mentality. Both Thomas Young Sr. and Jr. hoped that YESCO could be a vehicle for future generations to be pioneers in their own right and experience the kind of happiness and accomplishment they had known. Their vision and hope were that YESCO would continue to bless the lives of not only their families, but also thousands of employees and the communities where they live.

In 2021, the third generation of the family began formally transitioning the stewardship of YESCO to the fourth generation. I became the CEO that year, with two cousins working in key leadership roles. Each of us began working with YESCO in our teens and experienced success in our chosen career paths within the company. My cousins and I are the first YESCO leaders who have never owned company shares. The YESCO Stewardship Trust allowed us to make this transition smoothly by passing the trusteeship between generations without conflict from shareholders, and without triggering any tax or liquidity challenges.

We realized, however, that there were still potential threats to our desire for YESCO to be Evergreen. First of all, almost 30 years had passed since the trust began, and it became clear that during our children’s lifetime, they would confront the termination of the trust. This would force the family to confront the issues of control and ownership. Secondly, our roster of non-voting shareholders had grown to nearly fifty, and with no distributions and little opportunity to sell shares, they were functionally bound as shareholders with their inherited shares.

In 2022, we became aware of a change in Utah’s trust laws which extended the permissible lifespan of a trust. We decided to take a bold step—transition from a 100-year trust to a 1,000-year trust. The transition was no small feat and took over two years to organize. It required revisiting and refining the trust’s language and intent to ensure alignment with the family’s vision. The process reaffirmed our commitment to stewardship and company values, as well as remaining an Evergreen company. We have also begun an enhanced share repurchase program to better balance shareholder needs for liquidity with company reinvestment. While this process could take decades to complete, our vision for the future is to maintain a roster of shareholders who remain by choice and are committed to our vision and goals, while at the same time creating an off-ramp for those who choose to leave. One of the unintended benefits of this process has been the mending of family relationships as we have reconnected with cousins who were once estranged.

Whether you are a pioneering founder or, like me, following in the footsteps of pioneers, I hope our story might have some lessons that can be applied to other companies who aspire to endure the next 1,000 years. The whole idea of a business existing, and leaders serving as stewards for the benefit of others is at the core of the Evergreen movement. As I look to the future, along with my leadership team, we are clear that we aim to make YESCO an incredible place to work and grow responsibly, so when it’s time to hand over the reins, we can say we’ve honored the trust.

More Articles and Videos

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy