A Risk Worth Taking: Building an Evergreen Business

- Spencer Williams

- West Paw

In 1996, my wife—then my fiancé—and I were living in Vermont, where we had graduated college several years before. Originally from Columbus, Montana, I was looking for a way home. I had been raised on a ranch about 100 miles east of Bozeman, which my family had homesteaded and worked for five generations. My connection to Montana ran deep, and I felt a strong calling to come home.

The problem was, there were very few jobs available in Montana at that time. I was dissatisfied with my work selling institutional research to money managers and traders because I felt disconnected both from a tangible product and from the culture of the customers I served. A job in manufacturing and creating a company had always been a strong interest.

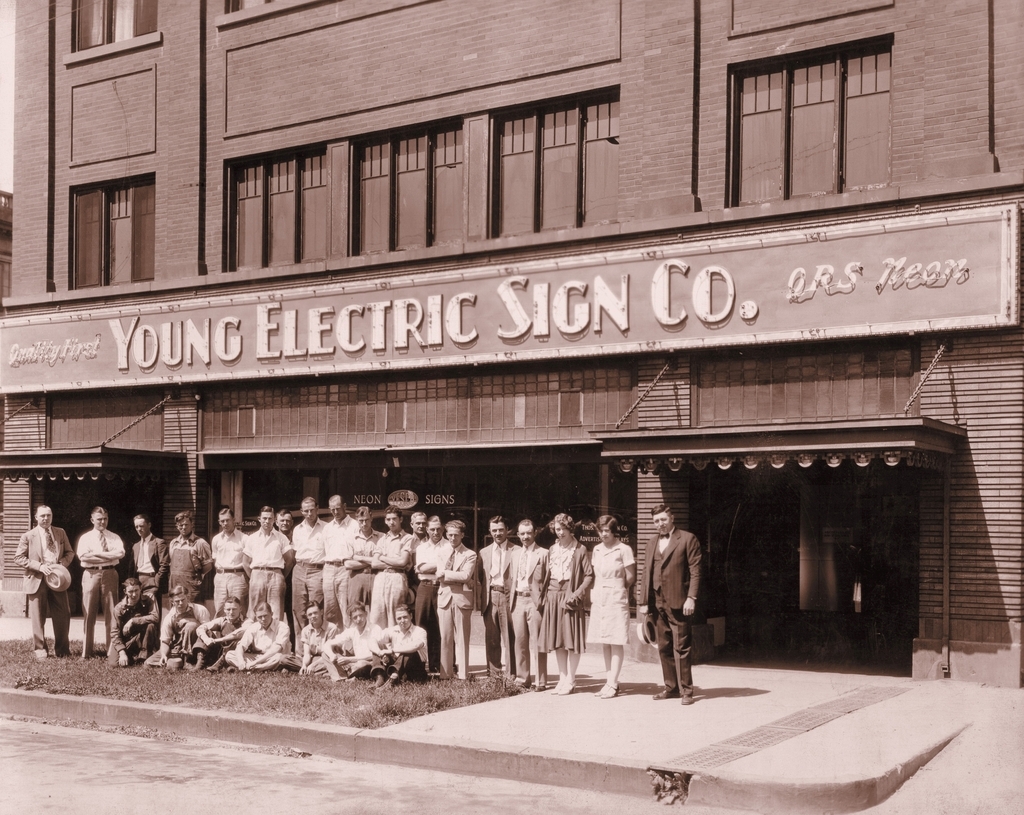

When I learned of an opportunity to purchase a small, homegrown business in Livingston, I said yes. The company’s founder, a seamstress, had built a business creating soft toys for dogs and cats, stitched by a network of home sewers, which were sold to about 200 independent retailers. It was at a scale where I could learn by doing the work, and the former owner had agreed to take my calls and discuss ideas and concerns through my first year.

All that to say, it was a risk—there was a real possibility that I could fail. But I jumped in with both feet anyway—not because I had a passion for pet toys, but because I had a vision to build and grow a company in Montana that would provide opportunity for people and positively impact the place I loved.

Having bought the business, I made a series of decisions in the first year that went against what the former owner and current business best practices advised. While I recognized the risk at each point, I felt strongly that every step was necessary for the sustained growth that would help ensure jobs and opportunity for people in our region. That was my north star.

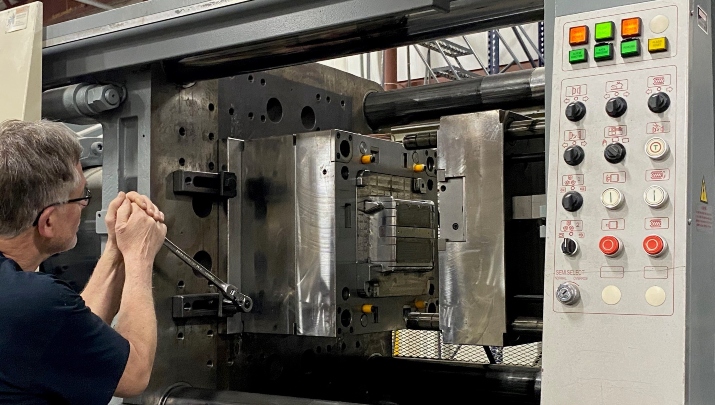

Those early decisions included renaming and rebranding the company—Pet Pals became West Paw, Inc.; attending an industry trade show, something the former owner had never done, to introduce our brand to a new audience; and, committing to maintaining a direct-to-retail model to keep us close to our retail partners and avoid being beholden to any one large customer. I also decided to double down on domestic manufacturing at a time when people were offshoring left and right. I knew that to honor my purpose of bringing good jobs to Montana, I needed to make our products here.

I think all of those decisions made in the early years of ownership were pivotal and represented what I recognize now as the first significant phase of growth in the life cycle of our company. In retrospect, they seem courageous, but at the time, they just felt right. I was willing to take big risks, and I think those big risks paid off because they were aligned with my core values and with where I wanted to take the company.

But if you were to chart our growth story onward from those early years, the graph would not reflect a straight upward trajectory to the right. We’ve navigated several periods of challenge, each ultimately an opportunity to recommit to sustainable growth and our purpose.

In 2008, the momentum and excitement of those early years had transitioned to what felt to me at the time like a slogging pace. I was burned out, and I found myself at an uncomfortable moment: I didn’t like my business anymore. I was ready to sell. I thought that if I could find the right local person who would keep the jobs here—or tell me they would—I was ready to get out.

Just about that time, my wife, Kerry, who from the early years had been a valuable advisor and was watching me struggle, shared an article with me about the National Center For Employee Ownership (NCEO). She encouraged me to attend an upcoming NCEO conference, and I went. It was the right decision. I came home both inspired by the idea of working toward employee ownership and with the realization that I needed to hire a management layer. If I was going to continue to grow the business, I needed a team around me.

Investing in my management team was a strategic and financial decision that allowed me to step away from the intensity of managing so many aspects of the business and get inspired again to grow the company. By 2012, with the support of the new hires and new products that continued to focus on environmentally friendly materials, we were in fact growing quickly and trying new things. But we found that we had grown into a problem, as well: one of those new things we tried was to change our production systems, which was a failure. By the end of 2012, we had a negative book value. We were not bankable.

It was that crisis—as it is for so many businesses—that really inspired us to open our books and implement the Great Game of Business (GGOB) operating system. I launched GGOB with a simple five-line P&L and conversations with the team about how we were growing and why we were bleeding cash. Then, we invited GGOB’s Rich Armstrong to Bozeman to help us implement the financial literacy portion of the operating system and the huddle rhythms. There’s no doubt that the crisis was painful, but implementing GGOB helped us come roaring back in 2013 with profitable growth. The entire team was able to see the impact of financial literacy and open-book management.

Over the next several years, we maintained profitability, but I started to recognize, again, a sense of stagnation. We were all getting a little too comfortable, and our growth was slowing—we seemed to have lost our hunger. It was clear that we needed to innovate to push into the next phase of growth. We did two things in response that provided the renewed momentum we needed: we brought in new product designers to launch new product lines and we began intentional training around growth mindset.

Through our in-house training curriculum, we focused on first asking the question: How can we show up in our work—across all positions from manufacturing to accounting—with a growth mindset, as opposed to a fixed mindset? We created related themes in the next couple of years to rally the team behind this approach. The first, in 2019, “Beat Your Commit,” was focused on stepping out of complacency and driving accountability; the second, in 2020, was “I Drive Growth,” honing in on how each individual can drive growth in their personal lives, the life of the company, and in our community. In 2021, we are once again on a high growth trajectory, and we’re embracing the theme of “Sustainable Growth”—a theme I hope will guide our Evergreen® company for many years to come.

When I started to grow our business in 1996, I don’t think I really understood that we could have a company of nearly 100 people, attracting employees from communities all around our region to work here every day over three shifts. While I had a vision of creating good jobs, I didn’t imagine the extent to which we could impact people’s lives. By providing careers and training, financial literacy, healthcare, and other benefits, West Paw is making a difference in families and communities, which brings me great joy. I’m grateful for the perseverance of our team to work through each challenge and continue to grow in our purpose.

Spencer Williams is CEO of West Paw.

More Articles and Videos

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy