How Pragmatic Innovation Helped Me Save My Faltering Company

- Pete Braun

- Wall-tech

I’m an accidental CEO. I stepped into this position four years ago when the company I was working for, Wall-tech, almost went out of business.

At the time, I was a minority stockholder and vice president. Wall-tech, which specializes in framing, drywalling and finishing, had been hit hard by the recession. We depend on new construction for much of our business, and as everyone remembers, new construction all but dried up after the housing bubble burst. The situation was dire and our board of directors was weighing liquidating the company. But I loved Wall-tech and couldn’t bear to see its 100 employees let go.

So I begged the majority stockholders for a chance to turn things around. They gave me three months.

Instead of giving in to the panic I felt, I moved into survival mode. My background was in architecture and construction, not business management. So I hired a good accountant and a CFO to help me figure out a plan. I pulled every penny out of my savings account and lined up a few personal loans, a business loan and an operating loan. I managed to cobble together around $2 million, enough to buy out the three former partners and keep all the employees on staff.

And then my real work began.

The buyout happened in the spring of 2013, and in order to get another bank loan that fall, we were going to need to show a good financial report card. Wall-tech had operated the way a lot of small businesses do, without a contingency plan. But now, in the midst of a financial crisis, I had to develop a plan that I could quickly implement and easily execute. Of course, execution is the hard part.

So I embraced a new concept for the company: Evergreen. In particular, I started promoting the Evergreen principles of Pragmatic Innovation and Profit. I looked at what was really going on in the company and I used that information to help me make decisions about the future.

I started with forecasting and strategic planning so that we could see where the company was headed over the next five to 10 years. Wall-tech was full of great people but had some underperforming divisions that looked like they could eventually sink the company. So we made the tough decision to downsize by cutting those divisions way back and selling most of the equipment to make sure we’d have no temptation to return those lines of business to that size again.

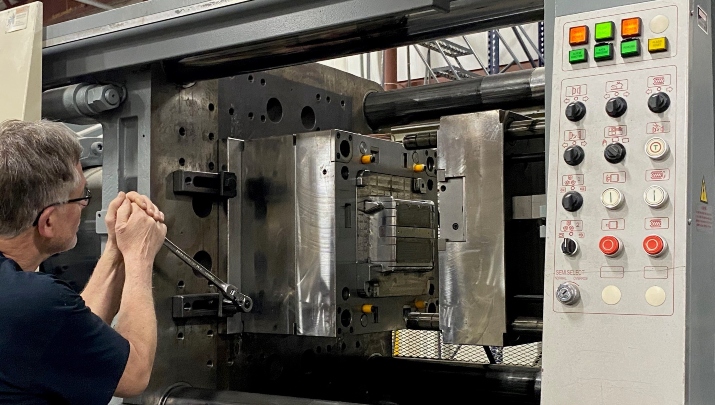

But the team strategy and forecasting meetings also revealed some promising news. It looked like there would be major labor shortages in the construction industry when the economy picked up, which would ultimately impact our customers’ ability to meet schedule demands. We decided to take a crack at the prefabrication-building-components division because the ready-made structures would allow us to adhere to our schedule and maintain our commitments. We were able to jump into the market with both feet and have been very successful there.

I’ve long been a devotee of Jack Stack’s Great Game of Business, so I implemented some of his teachings right away. Inspired by his open-book management ideas, we started doing financial-literacy training. Our company is spread across three states, so it can be hard to communicate sometimes. We set up a better system to keep key employees aware of our finances on an ongoing basis so they could make smarter decisions that would help our bottom line.

I also decided we should move to a Stack-inspired employee-ownership model. We made all of our office workers, foremen, superintendents and subforemen part of the employee-ownership plan, which was hard at first. Most of these folks would have been happier with cash than with stock, and some thought it was just a trick to make them work harder.

To make them more comfortable, I hired coaches from Jack Stack’s Great Game of Business to work with us. They helped us set up management teams where people could slowly become more involved in decision-making. We also started doing quarterly leadership meetings to encouraged people to step up and take responsibility.

Something else that really made a difference after the buyout was taking the politics out of the good-ol’-boys network. We got rid of nepotism, which was a terrible morale killer for many years, and made everyone’s job performance based.

It hasn’t always been an easy process. About two years ago, we had to lay people off. We lost track of our growth — it’s tough in our industry to always gauge where and when workers are needed — and committed ourselves to much better forecasting of seasonality and a better long-term mix of core versus seasonal employees. And of course, we then had to rebuild trust among the employees, which takes years. We don’t want to make that mistake again.

I remember one time, early on, trying to celebrate a win for our team by sending a note inviting everyone to meet for drinks at a tavern after work. Three people showed up. They just weren’t used to management and field operations mixing together. That told me we needed to work on culture and communication. Now we make a lot of effort to do group cookouts so that everyone knows they are welcome.

Today, I have 330 employees on staff; 84 of them are employee-owners. We’ve taken on over 50 apprentices in the last few years. We train people up and we make sure they know they are cared for. We brought in close to $18 million in revenue three years ago and we’re poised to bring in $40 million this year.

Thankfully, my risky buyout and commitment to Evergreen are working out — for me and for my employees.

Pete Braun is the Owner/President of Wall-tech.

More Articles and Videos

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy