How We Increase the Odds of Acquisition Success

- Mark Bernhardt

- Burgess & Niple, Inc.

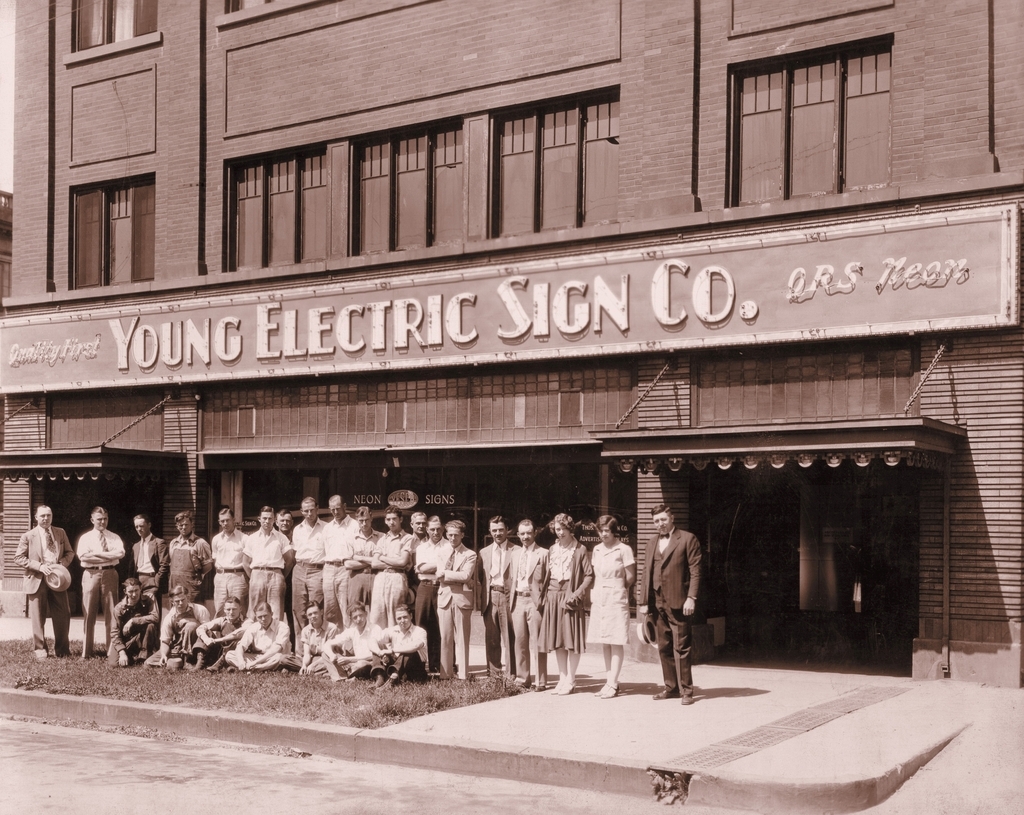

Burgess & Niple (B&N) is a 111-year-old engineering and architecture firm. Over the years we have done more than a dozen acquisitions. I joined the company in 1997, and as I came up through the ranks and made observations from where I sat, my impression was that many of our acquisitions didn’t take very well. It seemed that the companies we acquired were kept at arm’s length and never really became part of B&N, or it took years for integration to occur. It took me some time to understand it, but it’s clear to me now that the reasons behind these unsatisfactory results could help drive future successes: culture and staff engagement.

As an Evergreen® company, B&N’s culture and values are paramount. Being a professional services firm, we don’t make widgets. Our people are our greatest asset, which is why Talent is one of the top priorities outlined in our Strategic Plan. When I took over my role of President & CEO in 2019, we had not completed an acquisition in a decade. As we prepared for the first acquisition under our new leadership team, we sought to increase our odds of success by focusing on cultural alignment and engaging more staff in the process through what we have termed our “integration partners” program.

It starts when we are vetting a company to see if we think they would be a good fit to acquire. We dig into all the financial details and technical capabilities of course, but we have added another layer to perform a deeper level of cultural due diligence. This starts in a joint Visioning Session with leadership from both firms. We are big fans of Simon Sinek, and in this session, we talk about our Why, our Purpose, and what we can achieve together post-acquisition. We also use a cultural assessment tool that is shared with the new team before we go into the meeting. This tool has 20-30 cultural characteristics that are aggregated into different categories. The B&N team and the leadership at the firm we plan to acquire complete the assessment and then we evaluate cultural compatibility together. This helps us identify where we have the most in common and where the soon-to-be-acquired employees are likely to see and feel the greatest differences.

As we move forward with the acquisition, we start to lay the groundwork for assigning integration partners to reinforce cultural compatibility. Each person in the newly acquired firm is paired up with a B&N employee. Typically, a new employee’s integration partner is someone in a similar role, and often someone who has been through an acquisition as an employee of a company acquired by B&N. We dig into their staff’s resumes and develop a partner list as the first step. The B&N employees are then contacted and asked if they want to support the integration. We have found this is a great way to engage a wider cross-section of the firm in an acquisition and in our broader strategic planning goals.

We coach the B&N employees who agree to help on how the process will work and ask them to introduce themselves within a week or so of announcing the deal. Initially, they have calls about once a month and check in to share a bit about how long they’ve been with B&N, their experiences at the firm–both good and bad–and let their partners know that they are available as a resource. They help them with technical and policy questions, but most important are all the pieces that are not written down, like the cultural norms, and how we speak to and behave with one another. We also use these partners to collect important feedback about the onboarding experience. I, or someone from the leadership team, checks in after a few months have gone by. What is it like to be acquired by B&N? What works well and what needs to be improved? Our hope is that they form a relationship, and while we do not require that they keep it going for a specific amount of time, I know there are some people who still meet quarterly, even three years later, just to check in.

Aside from honoring our culture and improving employee retention, this process helps us become stronger and more competitive. We are a mid-sized engineering firm with 470 employees spread across the country. We are often competing with publicly traded firms with thousands of employees. Our model is made up of a network of small offices, which sometimes have as few as 10 or 20 people. If we want to go after big projects, we need to bring in resources from all around the company to make one big, virtual team that can go head-to-head with our larger competitors. As we onboard the new employees, we encourage the integration partners to pull their partners into projects, which gets everyone working in the trenches together, creates trust, and makes us all feel that we are one team. This has been a highly effective program for accelerating that kind of teamwork and assimilating people into the culture and various projects quickly and effectively.

This is similar in some ways to assigning new employees a mentor, but it’s different because the integration partner is always a peer. It’s not about training; it’s about getting to know someone and helping them find their place at B&N, and then stay on as a significant contributor. It’s important for new employees to have someone who is not a supervisor in this role; new employees do have supervisors and oversight, but this is a different kind of relationship.

Our acquisitions typically range in size from very small–about 10 or so–to upwards of 40 people, so this program does require the investment of some time and attention. Even though so many people are involved, this program is relatively simple and easy to run. It creates so much value that any costs associated are far outweighed by the benefits. Each time we learn more and continue to integrate acquisitions more effectively. It’s been a wonderful tool for strengthening our culture and growing our team and our capabilities in a culturally aligned and Evergreen way.

More Articles and Videos

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy