Inspired By Ancient Traditions To Build A 100-Year Company

- Vicky Tsai

- Tatcha

I found inspiration for my Evergreen business in Kyoto, Japan, among gold-leaf artists and geisha.

As an overzealous intern during my time at Harvard Business School, I had tested too many skin-care creams on myself and contracted a case of acute dermatitis. The only thing I could use on my skin was Aquaphor, which left a greasy residue, but blotting paper from Japan mitigated the shiny effect.

During my travels, I found myself in Kyoto, where I learned that the papers were the byproduct of gold-leaf manufacturing and that geisha had discovered their usefulness. When I met these women, I was immediately enchanted by them. Their white makeup didn’t hide their skin like Western makeup does; instead, it enhanced every possible flaw. But of course there weren’t any flaws, because the geisha had perfected the art of skin care. Their products were all-natural, from the days before cosmetic companies put questionable ingredients in lotions. I went to their apothecary, bought a bunch of geisha-recommended ingredients and started using them myself. Within eight weeks my skin recovered from the acute dermatitis that had plagued me for years, and I knew I had found my calling. I planned to create a skin-care collection — based on the timeless rituals that the geisha honed over centuries.

I started building Tatcha out of my one-bedroom apartment in San Francisco. As an entrepreneur in the heart of the tech world, I was tempted to go the venture capital route. All around me, I saw friends taking millions of dollars in investment money, selling out quickly and reaping the material rewards of a quick exit.

Given my long-term goal, though, that didn’t feel right to me. I was building my business based on my respect for these ancient traditions. I wanted to build something that would last 100 years.

I started like many small-business owners, using credit card debt and working multiple jobs for seed capital. When that ran out, I sold my furniture and engagement ring and worked four jobs. When that again ran out, I borrowed money from family and friends. At one point I considered selling the company despite the amazing traction we were getting, because I couldn’t figure out a financing strategy that would give us the runway and independence to create the brand in a way that would stay true to its vision. Thankfully, it was at that time that I met my business partner and future Tatcha president, Brad Murray. He came from the private equity world and has managed to keep Tatcha majority owner-operated while still securing the capital necessary to grow.

Our financial independence has allowed us to make decisions we wouldn’t have been able to make if we had fast money behind us. For example, as part of our purpose, we wanted to make sure that our business had a built-in charitable aspect, so we partnered with Room to Read. Every full-sized skin-care purchase from Tatcha or any of our retail partners sends an incredible girl to school for one day through Room to Read’s fund for girls’ education in low-income countries. Investors might have frowned on that diversion of funds, but I’m proud of the fact that in the first 18 months of our partnership we have raised enough for 1,000 years of girls’ education.

We don’t spend money like Silicon Valley startups typically do. Our offices are nice but not fancy. Until two years ago we were based out of my house, which was often bursting with products ready to ship. We spent on real estate only when it became completely necessary. We focus our spending on things we think are the most important, like product development and customer service.

Brad and I have not taken true salaries yet. We’ve opted to invest every dollar back into the company. Every year, I consider paying myself in the next year, but then I think about what that money could do back in our business, and I hesitate to make that change.

Sure, it would be nice to own my home and have a fancy new car — but those things matter less to me than building equity in my own company. Our hard work and frugal ways are paying off. Between 2011 and 2014, we grew over 10,000 percent. We had revenue of $12 million in 2014. We are on track to grow 50 percent in 2015 and expect to keep this pace up next year. This year we also debuted, at 21st place, on the Inc. 5000 list of the fastest-growing companies in the U.S.

I look at companies in Kyoto and I see how they’ve thrived over 14 generations. Through thick and thin, they’ve become part of their community. What I’m learning is that if you want to be around for 100 years, it’s best not to benchmark companies that are going to exit in five. Instead, you surround yourself with the kinds of people who share your values and you build a culture of sustainability. That’s truly the best way to grow for a century or more.

Victoria Tsai is the Founder of Tatcha.

More Articles and Videos

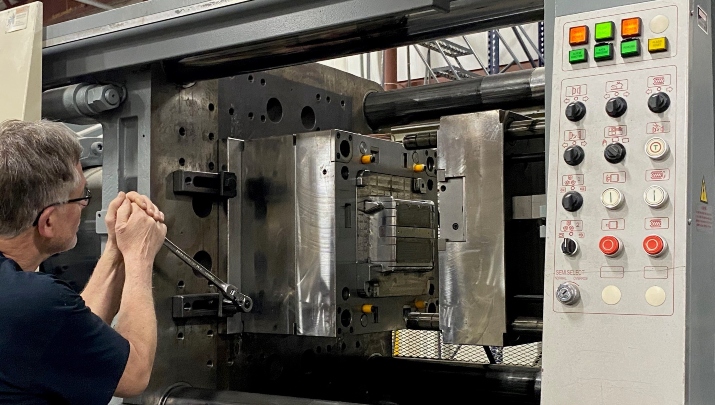

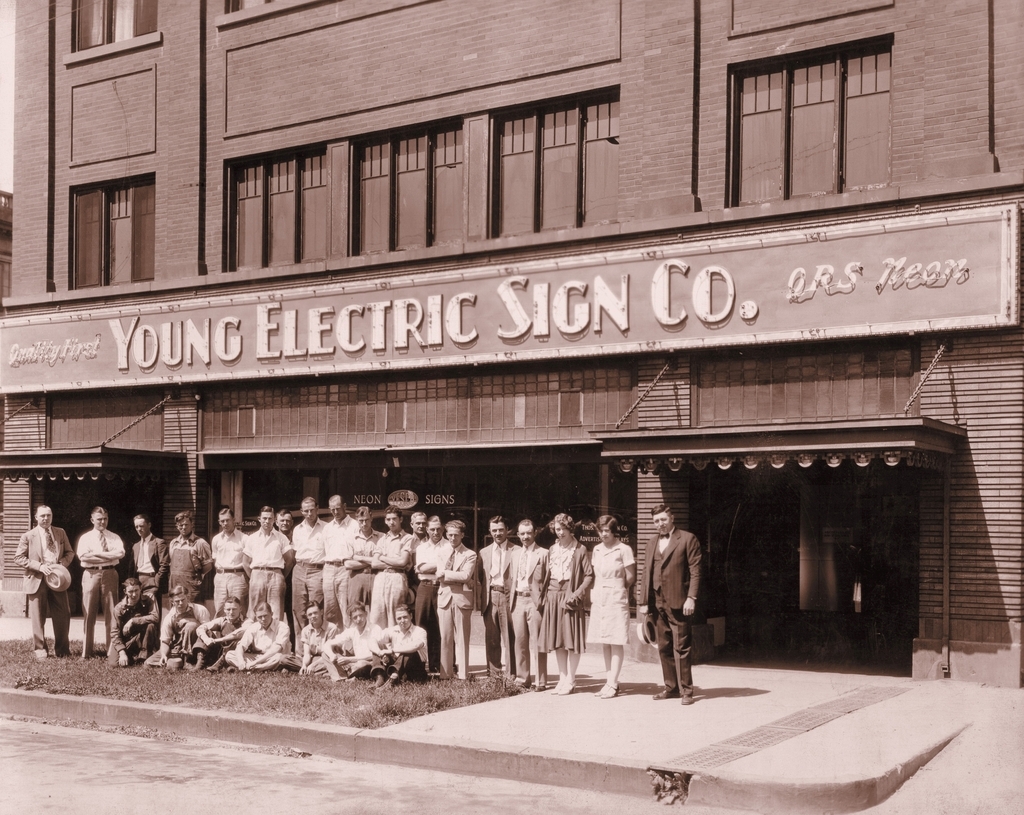

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy