Turning Green With Envy: Why I Want To Build An Evergreen Business

- Roger Thornton

- AlienVault

In the spirit of full disclosure, I must admit that my passion for the Evergreen model does not derive from some magical experience with a wonderful Evergreen startup, but rather from a lifetime engaged in the polar opposite model of financing and building companies. In fact, it might be difficult to find a person with a less Evergreen past. I joined my first venture-backed startup company straight out of college in 1987, founded one myself in 2002, and spent the bulk of my career in between working on early stage startups with a small group of VC’s in Silicon Valley. Even the few large companies I worked for long ago (Apple & Sun), were built to grow and IPO fast. But alas, I have become a convert. A convert to the other side of green.

I firmly believe that the Evergreen model is best suited for those that actually enjoyed and thrived in the “traditional” model (the venture path). I loved working in the traditional model. My own experiences have seen that model make hundreds of friends and colleagues wealthy beyond dreams and return billions of dollars to the wealthy people that were “kind enough to give us their money for a while.” I genuinely admire the VC’s I have worked closest with and yet I still think the Evergreen model is the best path forward for me.

So then why would someone like myself reject something that has worked well? Two reasons: one financial and the other sentimental.

The first is simply sound financial advice. If you have a large ownership position in a successful, growing business the last thing you want to do is sell that position (unless of course you think that business is headed for turbulent times). Let’s say you build a new company that grows to an enterprise value of $250M growing at 20-30% YoY (which would be a bare minimum prerequisite for an attractive exit for a technology company in the traditional model). Let’s say, as the founder and CEO, you own 10% of the company after 4 rounds of venture financing netting you about $15M after taxes upon the sale or IPO of the company (assuming you liquidate your entire position in an IPO). If you have done this, congratulations, you are clearly a great entrepreneur, but as an investor, you are an idiot – you just sold the thing every investor on the planet is looking for – growth! Before you sold, you had $25M working at a 20-30% growth rate and probably a nice annual dividend if it’s an Evergreen firm. Now you have $15M to go invest. Simply put, it is not sound investment strategy to sell things that are successful and growing – those are rare. The only assets you want to sell are those that you think are going to shrink in value. Of course you could IPO and retain your shares, but others have covered the pains associated with an IPO in today’s capital markets.

There is one key consideration to this advice: the risk exposure deriving from nearly all of one’s wealth (and income) derived from a single business. If that business falters you lose everything. Unless you were fortunate and born with considerable wealth, you may indeed want to cash in from the aforementioned business simply for the purpose of diversification. For first time entrepreneurs an IPO or sale coincidental with the goals of your VC partners can mean paying off a home and making long term, safe investments to ensure a comfortable retirement for you and your family. For the entrepreneur that has accumulated enough wealth and achieved diversification, the Evergreen model allows you to keep your money working where it works best and where you have the greatest impact on its growth – in the company you are running. Even if your Evergreen business grows at a slow rate, it is easy to outpace returns found in the broader markets today and your Evergreen dividends enjoy a favorable tax treatment. In order to safely do this, the entrepreneur has to be able to hedge the risk exposure in the business through other investments and this is why the Evergreen model is best suited for those that enjoyed success in the traditional model.

THE SENTIMENTAL REASON?

Letting go of what you have built gets more and more difficult over time. Perhaps the greatest joy one can experience in the professional world is to build a company from the ground up and get to carefully choose all the people that will form the culture of the new firm. I have often found myself saying, “I would rather fail with this team than succeed with some other.” Few people get to enjoy this. When you sell to a larger firm or in most cases when you go public, bureaucracy and oversight become the primary functions and little things like sales and product development take a back seat. This is a gut-wrenching thing to watch and, frankly, I don’t want to do it again. If I build a company that I like to work at, I want to stay there for as long as I can generate profits at a paced growth.

These days, I am working on another non-evergreen company, probably my last. I split my time between a home near my office in Austin, Texas and my home in Las Vegas, Nevada. Like most people that enjoy living in Las Vegas, I do my best to avoid the strip. However when I do visit there, usually to entertain friends visiting from out of town, I enjoy watching the omnipresent competition between the two fundamental types of gamblers you encounter in a casino. One is a reckless speculative fool, either oblivious to their statistical disadvantage or convinced that they will somehow be “the lucky one” and exit the casino a winner. Throwing caution, reason, and their money to the wind, they press on with reckless abandon and ultimately wake up, hung-over with an empty wallet, and head for the airport. The other competitor in this arena understands every possible variant of the game, establish a structural advantage, and then slowly and consistently grind out small wins over time by diligently and patiently playing their advantage. Am I referring to professional gamblers? No. I mean the casinos owners – the house. Some of the greatest Evergreen businesses and entrepreneurs ever could be found on that strip. There is a famous saying in Las Vegas, “There is only one way to make money in a casino – own the casino.” As far as starting new business ventures, personally I am done being a lucky tourist, I want to own the casino.

Roger Thornton is the Chief Technology Officer of AlienVault, a security company that develops a platform designed and priced to ensure that mid-market organizations can effectively defend themselves against today’s advanced threats. Roger’s career has been dedicated to the development of technology and new business ventures based on technical innovation. Over 25 years in Silicon Valley and abroad, he has drive the formation and growth of dozens of new companies and hundreds of products, serving in a wide range of roles from engineering, marketing and management to investor/advisor.

1: March 2014, National Venture Capital Association’s (NVCA) performance benchmark, the Cambridge Associates LLC U.S Venture Capital Index®.

More Articles and Videos

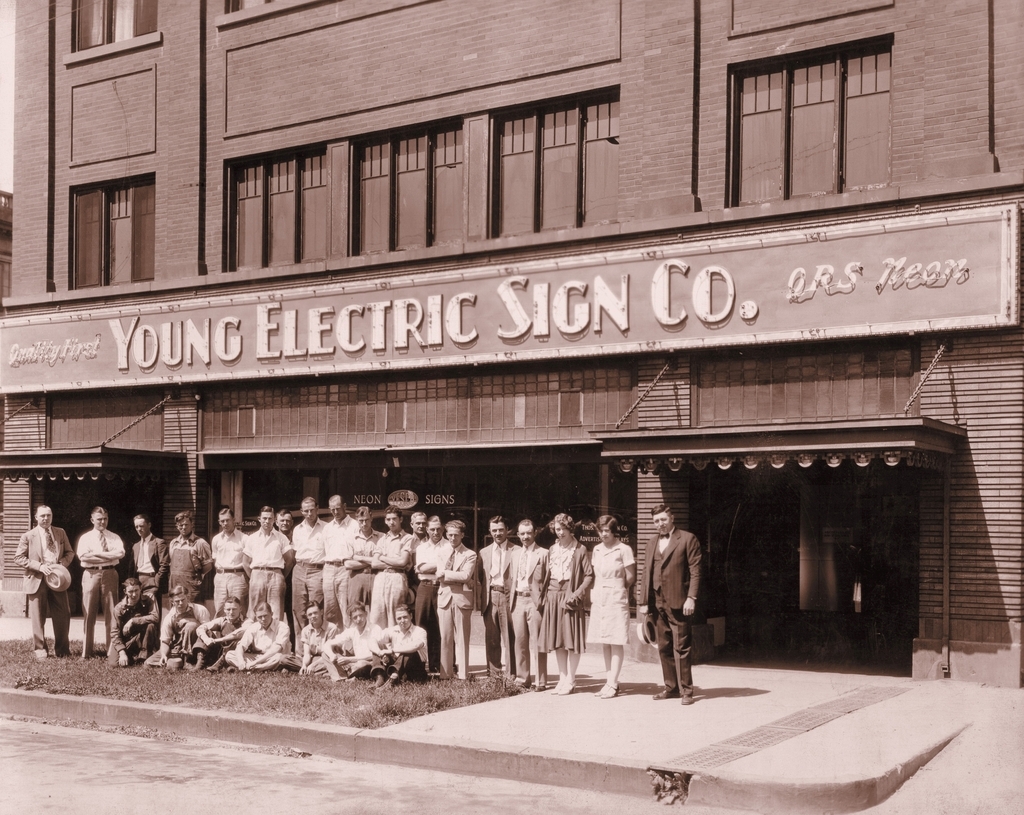

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy