Why I Tell Students They Should Consider Family-Owned Businesses

- Anne Smart

- Director, Family Business Center, Quinlan School of Business

Family businesses are, by their very nature, quiet. They don’t have to report on their financials, they tend not to promote themselves to investors, and any press can often mean unwanted attention on family dynamics.

So it’s not a huge surprise that most of the students I encounter through the business school at Loyola University aren’t thinking about family businesses as they assess their post-graduate job options. But as I like to tell them, if they don’t think about opportunities at family businesses, they’re shutting themselves off from what could be a very satisfying career.

I had my aha moment on family businesses around 2008. At the time, I was working at an outplacement company coaching C-suite executives who were looking for new jobs. In the wake of the financial collapse, many smart, talented people had been let go simply because their corporations needed to cut their budgets by 10 percent. These people hadn’t been let go for cause; they had been let go for purely financial reasons.

At the same time, I was consulting at the Family Business Center at the Quinlan School of Business at Loyola University in Chicago, where I am now the director. I was facilitating small groups of leaders from family-run businesses who were coming together for support and to learn from each other.

These executives were facing the same economic challenges as the big corporations that were laying off C-suite executives. But they were dealing with them very differently. They were being creative and purposeful about finding ways to retain their employees. They weren’t worried about their debt because they didn’t usually have much. They weren’t just thinking of themselves and their bottom line; they were thinking about what would be best for their entire work community.

I saw that family-run businesses have a different set of values, and that attracted me. I decided I wanted to work with people who are trying to create lasting value in their businesses and their communities.

There’s a lot of overlap between family-owned businesses and Evergreen companies, many of which are family-run today, or eventually family-run after the first generation. Both groups tend to put People First — paying as much attention to the growth and well-being of their employees and customers as they do to their Profits. Both groups tend to avoid outside investments and debt. And companies in both groups tend to have a deeply held Purpose that serves as their north star.

Twice a year I go into the classroom to make my pitch for family-run businesses. Here are the advantages I lay out for the graduate students:

A Bigger Mission

Millennials are children of the recession. They’ve learned that work needs to be about more than a paycheck — that it needs to be satisfying in a deeper way. So they’re looking for mission-based companies. Family-run businesses often fall into this category. Many family businesses that have been around for several generations have kept the company (and the family) together by having everyone focused on a bigger goal. That can be as simple as keeping the company in family hands or as big picture as trying to make the world a better place.

Opportunity To Advance

Public companies tend to be very rigid in their hiring and promoting policies. If you start at the bottom, you’ll have to work your way up through many layers in a way that could take years. Family businesses are different. They are usually just looking for the best people for the job and are looking for team members who are loyal and talented. And as an outsider to the family, new employees often have fresh ideas about how to make the business better. I tell the students they may find that they have more chances to advance more quickly at family businesses.

Sustainability

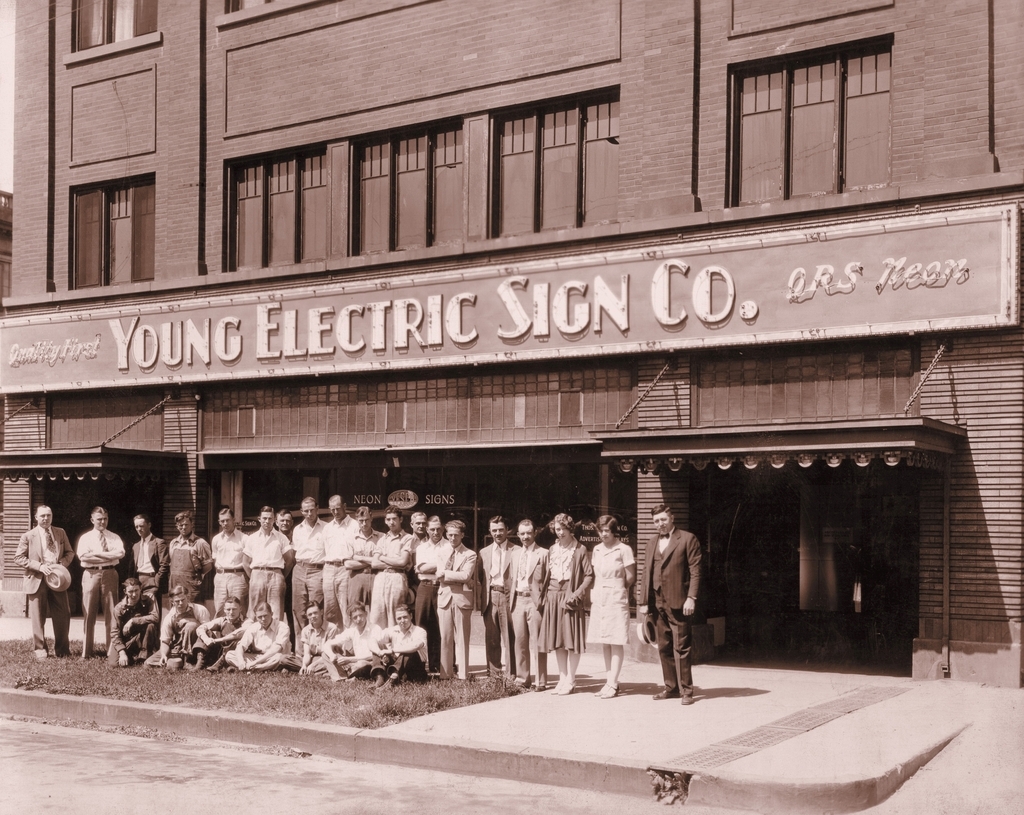

Students tend want the startup experience — where they jump into the chaos and excitement of a new company knowing it could all go away at any minute — or they want stability. For students looking for a more grounded environment, I recommend family-run businesses that have been around for three or four generations. Any company that old will have gone through almost everything the economy can throw at a company. It’ll be well-prepared to weather the next storm while remaining nimble and able to flex for the changing marketplace.

Responsibility To Employees

The average tenure for a CEO at a public company is five years. At family-run businesses it’s 20 years. CEOs and employees may have similar tenures and are mutually invested in the company and their teams. Family businesses also usually consider their businesses, and everyone who works there, as an extension of their actual family. That creates a sense of caring and responsibility that you don’t find at many public corporations.

Ability To Contribute

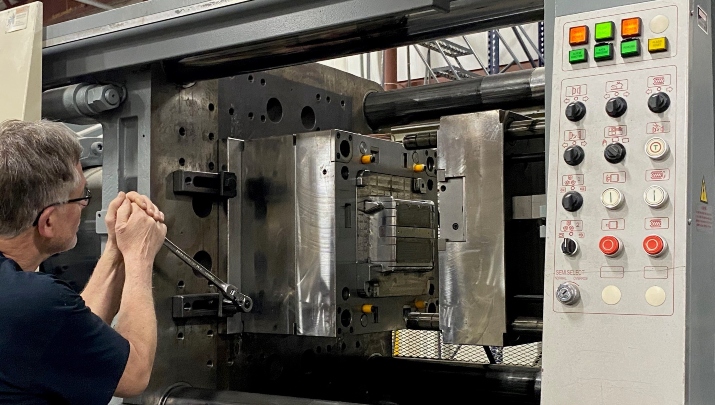

Our students leave school eager to dig in and play a real role wherever they decide to work. Recently I heard of a student who did an engineering internship at a family business. He developed a new product idea and the company let him lead the development team in building it.

All of this advice comes with caveats. Not every family-run business (just like not every Evergreen business) is the same, and ultimately the most important thing is finding a good professional, developmental and financial fit. But I’m glad to see the students putting family businesses into the mix more and more often. They are real assets to these companies and will find real satisfaction in their careers with them.

Anne Smart is the Director of Family Business Center within the Quinlan School of Business.

More Articles and Videos

Fireside Chat with Dave Thrasher, Dan Thrasher, and Dave Whorton

- Dave Thrasher, Dan Thrasher, & Dave Whorton

- Supportworks and Thrasher Group

Get Evergreen insight and wisdom delivered to your inbox every week

By signing up, you understand and agree that we will store, process and manage your personal information according to our Privacy Policy